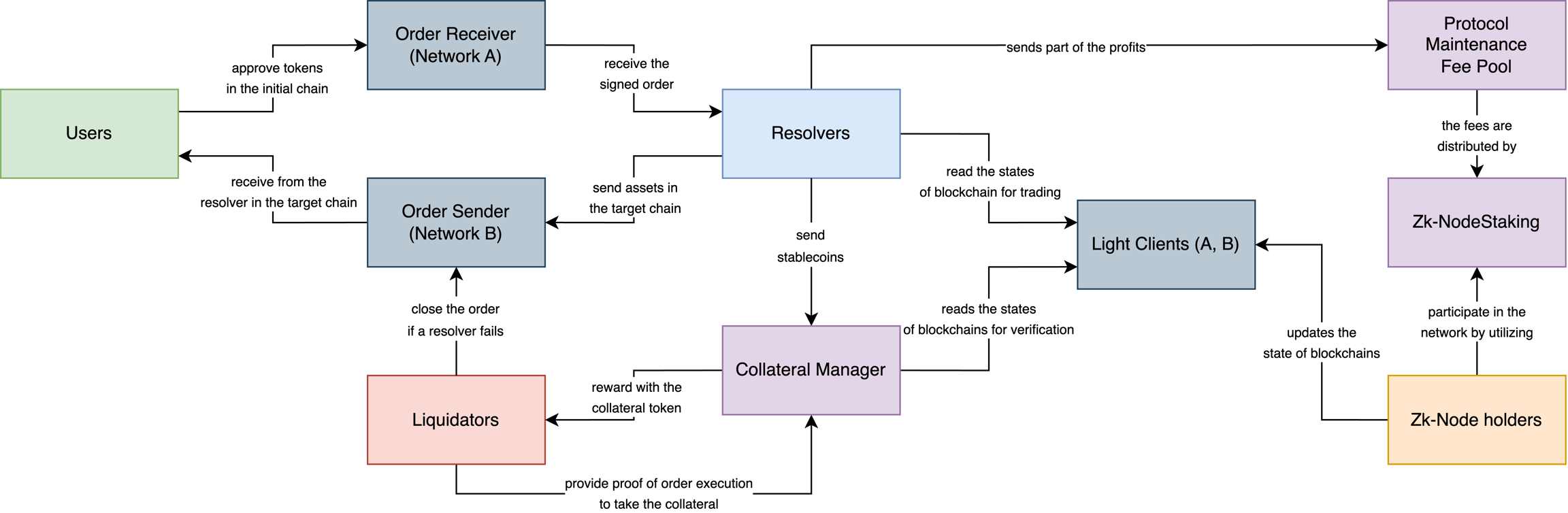

Workflow

To be eligible to execute orders, Resolvers need to provide any authorized stablecoin (USDT, USDC, DAI) to a

CollateralManagercontract.Collateral can be deposited in an ERC-20 token of authorized stablecoins (USDT, USDC, DAI, etc.) This token can be slashed by Liquidators in case the order execution fails.

Maintainers must stake in Kinetex DAO to be eligible to maintain the protocol. The DAO stakes serve as a guarantee of a fair distribution of work among Kinetex Maintainers. It can be slashed if a Maintainer fails to complete the assigned task or update the state of Light Clients or attempts to abuse the protocol. Maintainers are rewarded for completing different tasks, such as updating the state of Light Clients, providing computing power for ZKP generation, matching orders, and validating the order flow.

Resolvers pay to the Kinetex DAO pool in the form of a protocol maintenance fee. Fees ensure that Maintainers are motivated to complete assigned tasks and keep the system fair, and Resolvers always have the actual state of light clients.

Not only Resolvers can use the protocol. Anyone can utilize Kinetex Light Clients inside their applications but must pay fees to the protocol maintainer pool.

Resolvers can borrow additional liquidity from the Liquidity Pool by pledging their collateral. This pool provides multi-chain over-collateralized loans for supported assets (primarily stablecoins).

Last updated