Liquidity Sources

Nowadays, a majority of DeFi services offering cross-chain transactions have a rather inconvenient and inefficient algorithm of actions for users. As the DeFi industry strives to be decomposable, there are a lot of individual projects that perform swaps and bridging.

Therefore, users need to sort through many projects on different networks, select the DEXes and bridges necessary for the exchange, analyze liquidity and rates, and carry out all the exchange steps manually using different and often unfamiliar interfaces.

In addition, all DEXes have their own separate liquidity and pools that cannot be conveniently and simultaneously accessed. The problem is that each pool has different prices and sometimes insufficient liquidity to ensure low slippage, especially when users make high-volume trades.

Bridges have similar problems as most do not provide support for an adequate variety of networks and may also have limited liquidity.

All this leads to the lack of a universal solution for cross-chain asset exchange in the DeFi sector.

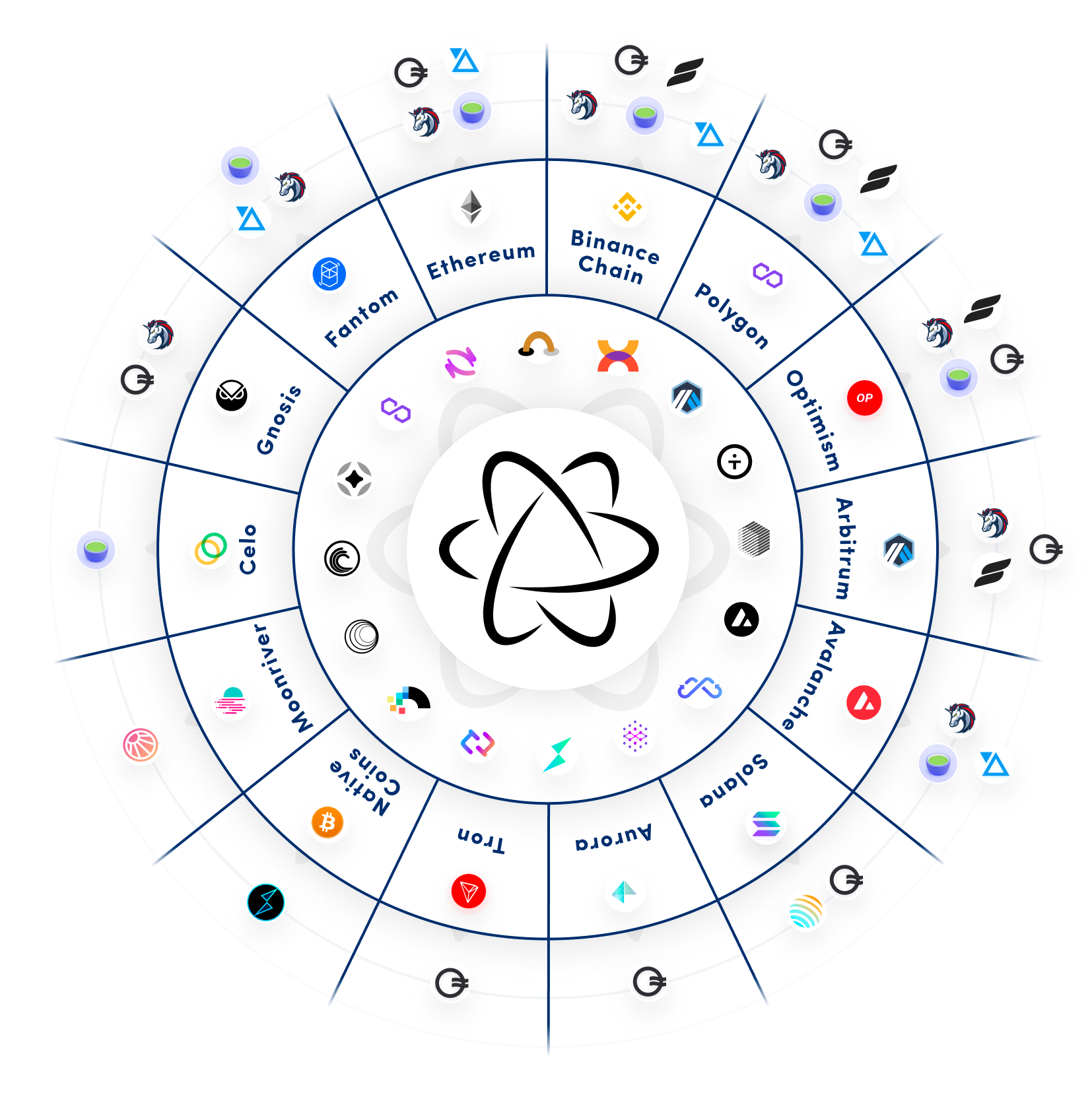

Acting as a meta cross-chain aggregator, Kinetex solves these problems by combining many sources of liquidity across all supported networks. Such sources include, but are not limited to:

DEXes and DEX aggregators (that combine more than 80 DEXes across different networks);

Bridges (more than 20);

Limit order protocols (1inch Limit Order protocol, 0x etc.);

Market makers liquidity

The combination of all the liquidity sources mentioned above allows users to use all the exchange options in one interface and receive the most favorable rates.

We constantly integrate new sources of liquidity based on the community's wants and needs.